We Simplify Loan Processing

For Mortgage Pros

We Help Mortgage Companies Do Better By Doing Less!

LET'S WORK TOGETHER

We understand you do not get paid unless the loan closes, we work the same way. All fees are paid at closing through Title at disbursement. Yes, this means Borrower Paid, the Brokers/LO’s pay nothing for our services.

10K+

Loans Closed42

States100+

Loan Processors

Find out which package is right for you.

Package A + LOA

LOA/Processor Hybrid-

Everything included in Package A + LOA Services for Prequalification and Preapprovals

-

Processor - Collect borrower documents to calculate income

-

Processor - Help setup prequalification, preapprovals

-

Processor - Submit TBD to lender if needed

Package A

Initial Disclosures to Close-

Loan Officer - Complete the application and obtain purchase contract if applicable

-

Processor - Send and retrieve signed initial disclosures + all supporting borrower documents needed for underwriting

-

Processor - Order 3rd party items such as Title, HOI, etc.

-

Processor - Submit to underwriting

-

Processor - Work directly with client to clear conditions and prepare for closing

-

Processor - Close the loan!

-

Processor - Post close audit

Package B

Submission to Close-

Loan Officer - Complete the application and obtain purchase contract if applicable

-

Loan Officer - Send and retrieve signed initial disclosures + all supporting borrower documents needed for underwriting

-

Processor - Order 3rd party items such as Title, HOI, etc.

-

Processor - Submit to underwriting

-

Processor - Work directly with client to clear conditions and prepare for closing

-

Processor - Close the loan!

-

Processor - Post close audit

Streamlines & IRRRLS

Submission to Close-

Loan Officer - Send and retrieve signed initial disclosures + all supporting borrower documents needed for underwriting

-

Processor - Order 3rd party items such as Title, HOI, etc.

-

Processor - Submit to underwriting

-

Processor - Work directly with client to clear conditions and prepare for closing

-

Processor - Close the loan!

-

Processor - Post close audit

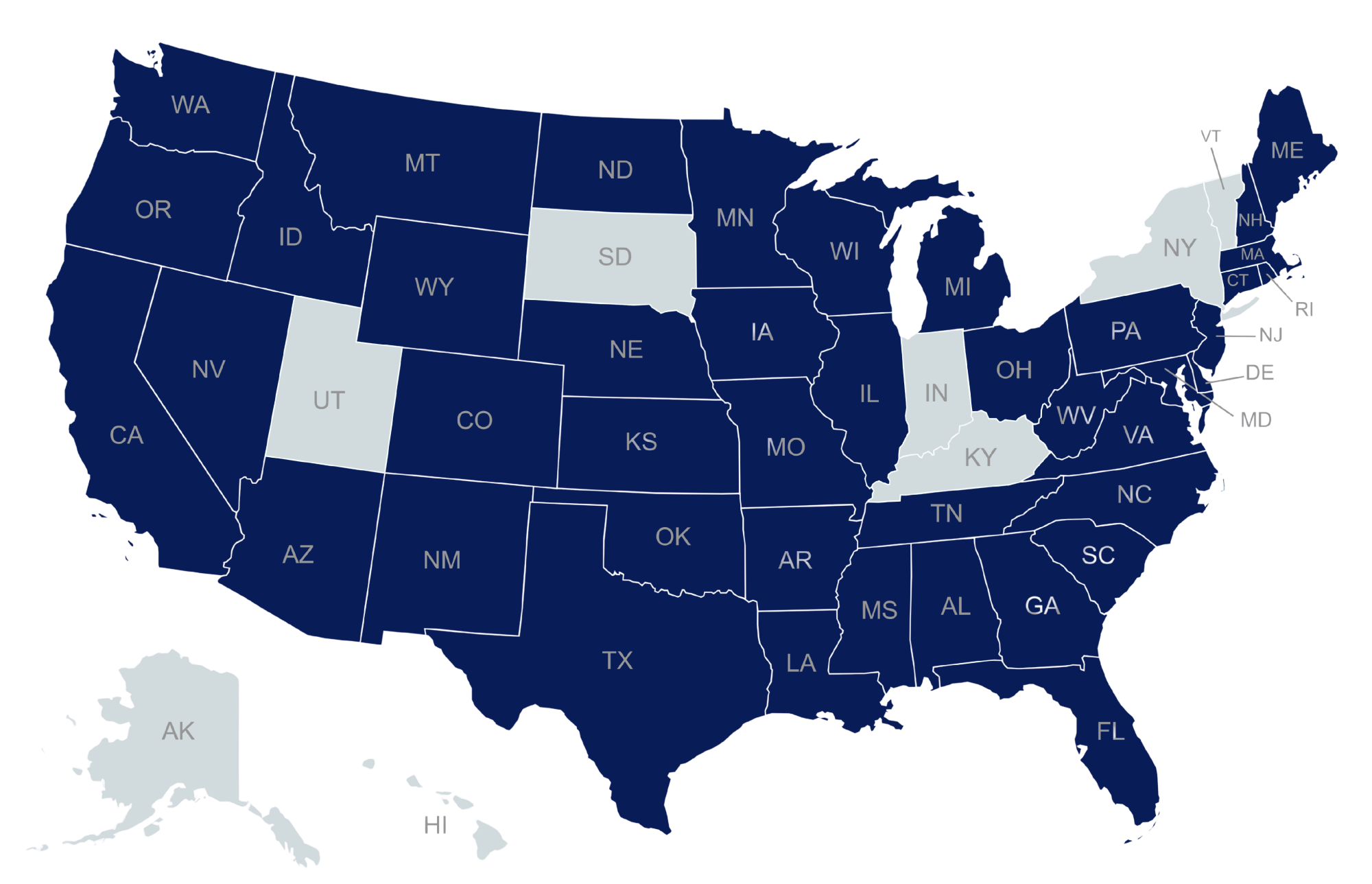

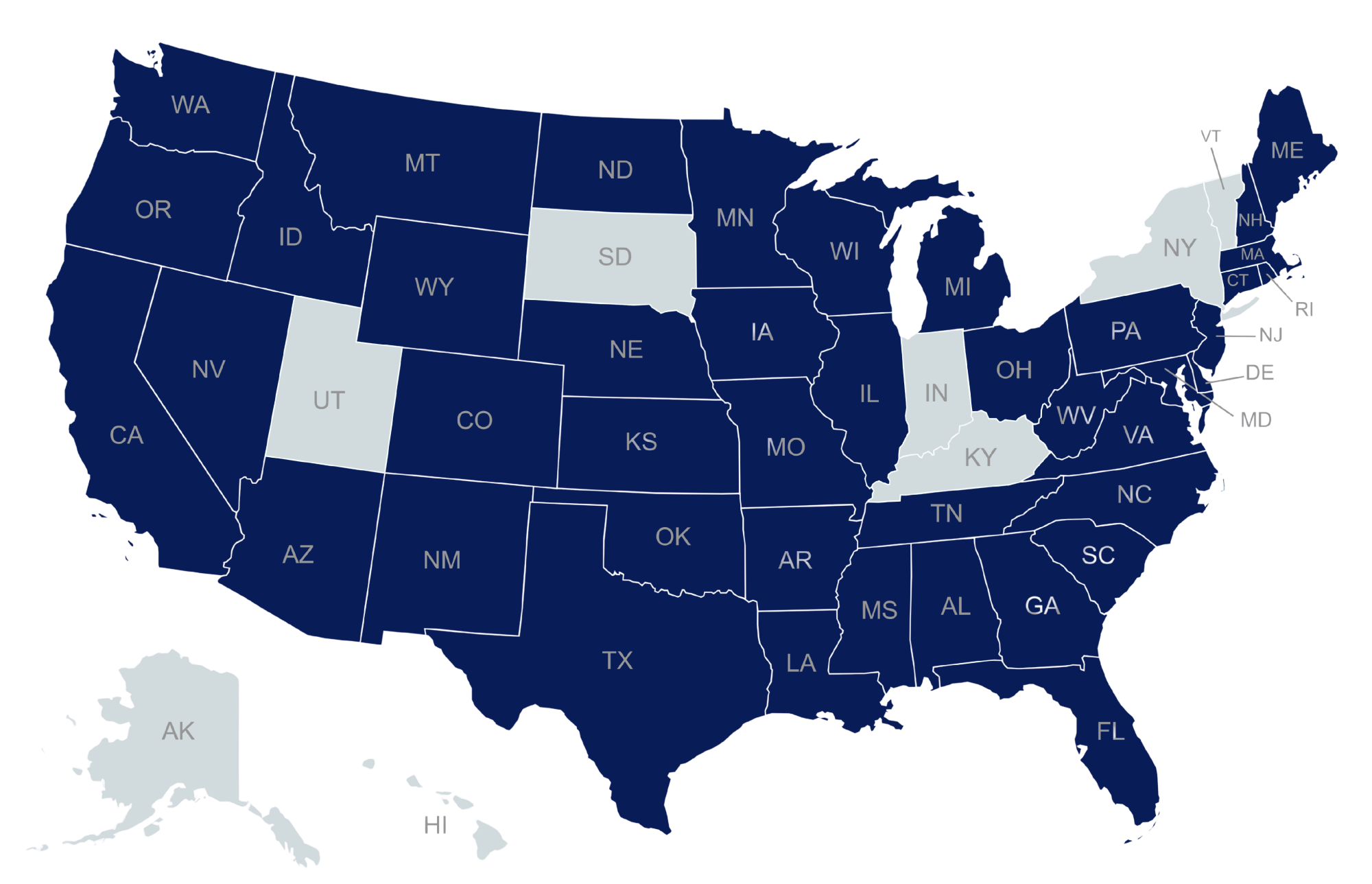

We do business where you do business

We are currently doing business in 42 states!

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

You Write'em, We Close'em

We work with the products you sell

- Purchase & Refinance

- Primary, 2nd Home & Investment

- Full Doc, Streamlines & IRRRLs

- FHA, VA, USDA & Conventional

- DSCR

- Non-QM

- Reverse

- Commercial

- Non-Delegated Correspondent

- Correspondent

Our Clients Love Us!

Frequently Asked Questions

YES!

We have processors in every time zone to cover your needs, and we have a lot of processors to choose from for you to find the right fit for someone to work with.

NO!

We work out of YOUR systems the way YOU want as if you hired a processor internally. None of this “You need to check our client portal”, or “You need to do A, B, and C in our system to view the status of your loan”. Nonsense. With us, you check YOUR system to see your loan status as we work on your loans out of YOUR LOS, so you always know where everything is at. To be frank, no one in mortgages needs another portal, login, or system to keep track of, it’s exhausting. If you use Arive or LendingPad, we can link directly into your LOS and you can directly assign processors within your loan file.

YES!

We do NOT do a round robin setup. The relationship with your processor is the MOST important aspect of closing loans smoothly.

We are ALL ABOUT building relationships with a processor instead of changing hands all the time. No round robin, work with the same person every time, unless you want to change, in which case go get’em tiger just select someone else on our team to send your next loan.

YES!

We can hire and pay your processors instead of you, and you can put the fee on the LE/CD instead of paying for it out of your pocket. It goes in Section B so it does not count against QM or high cost.

We provide your processors more opportunities; They can take on additional accounts to close more loans and make more money without having to come to you asking for a raise when you are slow. You never need to worry about providing them enough income.

We pay our processors well so that they are committed to working your files.

No, you do not need to pay us directly.

You put our fee on the LE and CD to charge to the borrower. We are paid at closing by Title, you don’t need to worry about getting us paid.

NO!

We are a genuine third party processing company. We are not an independent contractor processor. There is a HUGE difference. Our fee is disclosed in Box B of the Closing Disclosure, just like an appraisal. So, our fee will not factor into 3% QM rule.

100% of our team is based in the US.

Get in touch with us

Contact us today to DO BETTER.